In our previous blog post, we introduced you to the Millennials, their ideas about families and how they interact with brands. Now we will discuss five ways brands can connect with and engage Millennials.

5. Let Millennials share their stories. Make them feel that their voices are being heard.

Millennials want to not only acquire memories – they want to share their experiences – and brands should allow them to do so. Whether by allowing them to post videos on the company’s Facebook page or using their photos and testimonials in a commercial – the method does not matter. As long as their friends know what an awesome life they live.

So what should we take away? Millennials want just a few things while shopping:

Share their memories and experience, have their voice heard, multi-channel shopping experience, customization options and of course – discounts. Let’s market WITH them.

Sources:

- Pew Research Center (http://www.pewresearch.org/fact-tank/2016/03/31/10-demographic-trends-that-are-shaping-the-u-s-and-the-world/)

- EventBrite (https://eventbrite-s3.s3.amazonaws.com/marketing/Millennials_Research/Gen_PR_Final.pdf)

- http://thegbrief.com/articles/customization-the-key-word-in-millennial-buying-habits-621

- https://www.entrepreneur.com/article/234891

- http://www.forbes.com/sites/leeseymour/2016/01/15/millennials-will-spend-trillions-on-live-events-as-long-as-they-get-a-discount/#4af59f4938f4

- https://www.bloomberg.com/features/2016-millennials-coupons/

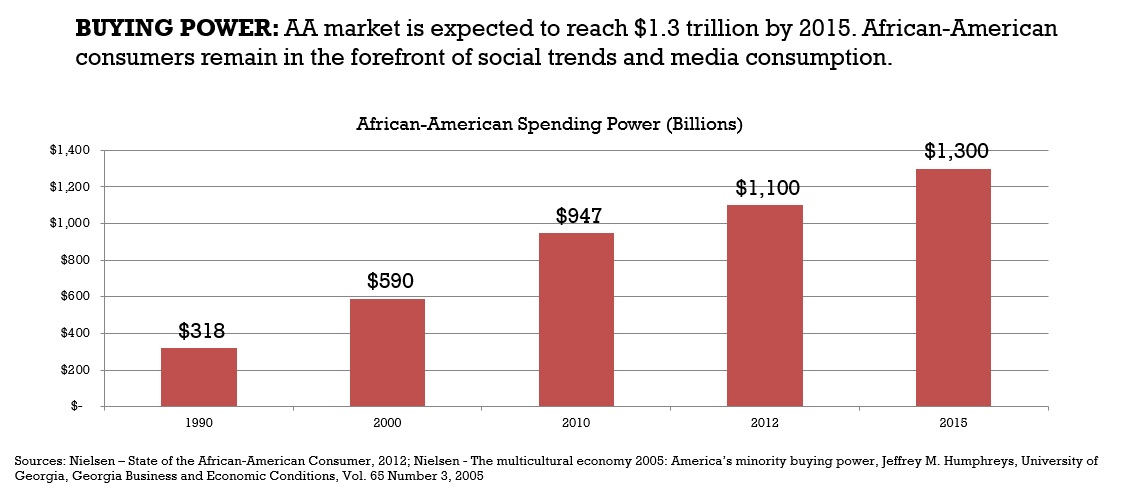

These numbers are proof that African-Americans are an important and powerful population that brands and marketers cannot afford to overlook. Every marketing plan that’s developed to reach a diverse consumer base must include strategies to reach out to African Americans. Why? Because African-American consumers look for products that represent their image and cultural values. Successful brands align with core values and speak to black consumers by communicating quality and value.

These numbers are proof that African-Americans are an important and powerful population that brands and marketers cannot afford to overlook. Every marketing plan that’s developed to reach a diverse consumer base must include strategies to reach out to African Americans. Why? Because African-American consumers look for products that represent their image and cultural values. Successful brands align with core values and speak to black consumers by communicating quality and value.